A woman walks past a Westpac bank advertisement in central Sydney, Australia.

Daniel Munoz | Reuters

Mastercard reported third-quarter earnings on Tuesday that beat analysts' expectations on the top and bottom lines.

Shares of Mastercard were up 1% in premarket trading.

Here's what the company reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

- Earnings per share: $2.15 adjusted, vs. $2.01 expected

- Revenue: $4.47 billion, vs. $4.42 billion expected

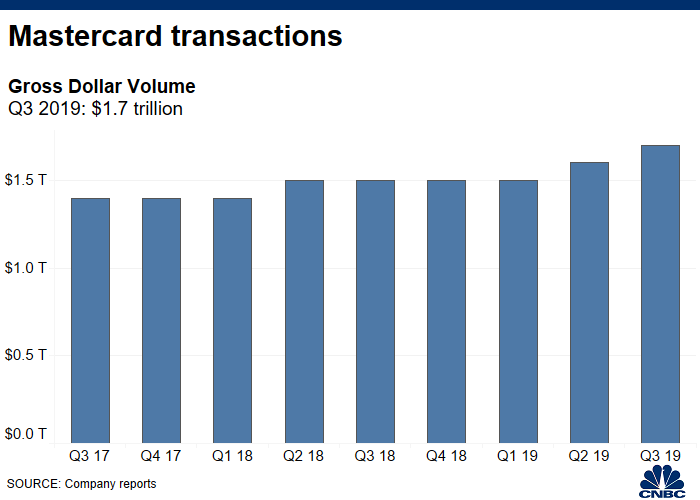

Gross dollar volume, the dollar value of all transactions processed, came in at $1.7 trillion — 14% higher than the year-earlier period when the company reported gross dollar volume of $1.5 trillion. Domestic dollar volume increased to $494 billion from $442 billion during the third quarter of 2018, almost a 12% increase.

The strong volume growth comes despite weak U.S. consumer data in September. U.S. retail sales missed economists' projections and dropped 0.3% in September, the first decline in seven months. Consumer confidence data also missed expectations for September, coming in at 125.1 as compared with the 133 estimated.

Mastercard's business in Europe also came in strong during the third quarter, with gross dollar volume for the region of $507 billion, up 16% from the year earlier period.

During the second quarter of 2019, Mastercard's global gross dollar volume rose 13% from the year-earlier period to $1.60 trillion.

Net revenue increased 15% from the year-earlier period not only due to an increase in gross dollar volume, but also an increase in switched transactions and cross-border volumes.

"We have recently expanded several key customer relationships, announced our Mastercard Track suite of B2B solutions and launched the faster, more secure click-to-pay online checkout experience," CEO Ajay Banga said in a statement about the earnings beat.

In the year-earlier period, Mastercard reported third-quarter adjusted net income of $1.90 billion, or $1.78 per adjusted share, and net revenue of $3.9 billion.

According to FactSet, 30 analysts have a buy or overweight rating on shares of Mastercard as of Tuesday morning. The average target price of all analysts surveyed by FactSet is $309.47.

This story is developing. Please check back for updates.

Read More

No comments: