An exclusive partnership with Cheesecake Factory and deals to deliver for Chipotle Mexican Grill, Five Guys and other local restaurants made DoorDash the leader in U.S. meal delivery last month.

According to data from consumer analytics firm Second Measure, DoorDash has taken 35% of the meal delivery market. Publicly traded rivals GrubHub and Uber Eats have captured 30% and 20% of the market, respectively.

DoorDash is also the fastest growing, with sales increasing 114% since October 2018, while the overall market grew by 40%.

Analysts say meal delivery has even more room to grow. Last week, Morgan Stanley published research showing meal delivery services only address 6% of the $350 billion dollar quick-service restaurant market.

In a note on Wednesday, Peter Saleh, managing director and restaurants analyst at BTIG, added that "restaurant delivery will survive, if not thrive, given the healthy consumer demand for the service across quick service, fast casual and casual dining."

DoorDash is reportedly planning to enter the public markets through a direct listing, according to a Bloomberg report. Based on recent investments, the company's valuation is approaching $13 billion, the report said.

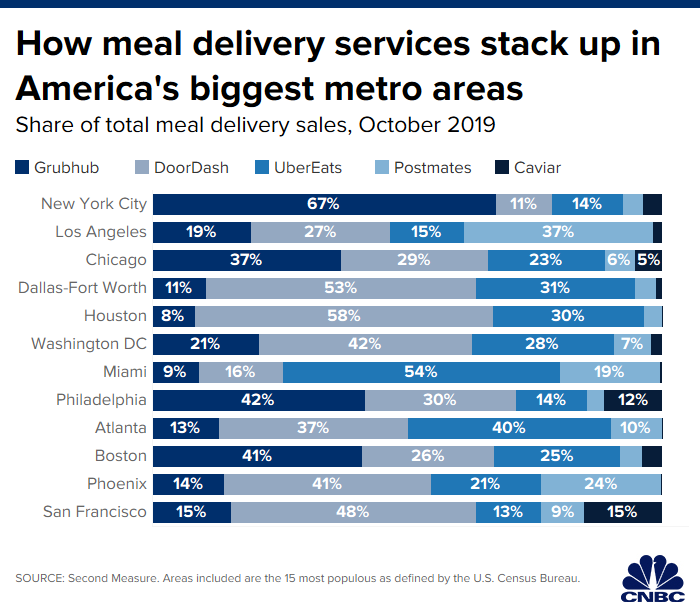

The meal delivery leader may now have the biggest share of customers nationally, but the landscape remains fragmented in major cities.

According to Second Measure data, DoorDash has the most customers in Washington D.C., Houston and San Francisco. GrubHub is the dominate player in New York City while Uber Eats grabs the top spot in Los Angeles.

And, although DoorDash is increasing market share, it's also facing increased scrutiny.

D.C. Attorney General Karl Racine is accusing the company of "deceptive" business practices, alleging DoorDash kept tips meant for workers and mislead customers about where their tips were going. Racine is seeking to recover millions of dollar in tip money that customers paid through DoorDash over the last two years. In July, following a petition from workers, DoorDash changed its policy, which had allowed the company to keep a portion of driver tips.

The overall meal delivery business is also facing increasing pressure on margins with the rise of price comparison tools available on Google and through the site FoodBoss. Adding to those headwinds, WeWork's tumultuous past few months have raised suspicion over the valuations of aggressive entrants into traditional industries like food delivery.

Some analysts see GrubHub as the poster child for the industry's challenges. The company has seen its market value cut in half this year as it spends heavily on promotions to stave off growing competition.

.1574374800259.jpeg)

Shares of GrubHub plunged 43% on Oct. 29 after reporting disappointing orders last quarter and issuing a dismal forecast for future sales. That was the stock's worst day of trading since going public back in April 2014.

Second Measure will publish its full report on U.S. meal delivery on Friday afternoon.

Read More

No comments: